Together, we deliver the energy transition

Ikigai supports infrastructure investors and operators to de-risk prospective ‘stranded assets’, to optimise their asset and improve their profitability while decarbonising their operations.

We believe it is important to create the right financial conditions around the technologies supporting the energy transition and create bankable projects for institutional investors.

We aim to create the cash flow today for the infrastructure of tomorrow.

Energy transition advisor and co-developer

Ikigai has three main complementary business lines:

A strategic and bankability consultancy to institutional and strategic investors and large energy consumers to decarbonize their operations, optimize their current infrastructure, and reduce stranded asset risk.

A development platform that delivers holistic, onsite energy solutions to large energy-intensive industries and critical national infrastructure owners. Ikigai structures, co-develops, funds, and manages the development of projects working collaboratively with our clients. The solutions are delivered either off-balance sheet or on a fully funded basis through specialized investors.

A bankability accelerator for technically proven, but not yet commercially-scaled, energy transition-focused technologies.

Why Ikigai?

Solution oriented

Ikigai's approach is solution-oriented. We will explore the best solution for our clients and work towards delivering it on the ground

Innovative

Ikigai's approach is innovative. We work closely with new technologies to create the best bankable solution to satisfy our client's objectives

Customer Focused

Ikigai is customer-focused. We listen to our clients' energy challenges and act upon them

Value Driven

Ikigai is value-driven. All our solutions are aimed at creating value for our clients and their shareholders

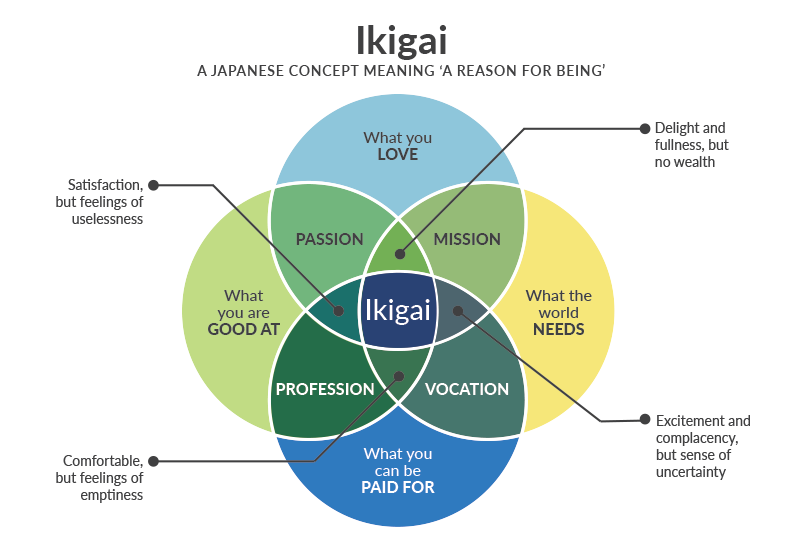

What is your Ikigai?

生き甲斐 (Pronounced [iki-gai]): Reason for living

Ikigai is a Japanese philosophy that encapsulates why we founded this business. The four pillars of ikigai represent the foundations on which our holistic, bankability-led approach to accelerating the energy transition is built: passion, mission, profession and vocation.

Together with our core stakeholders – investors, industry, and technology – we are helping large energy users move towards more sustainable, more resilient, and ultimately more profitable energy solutions.

Our mission? To deliver the energy transition

Ikigai bridges the gap between investors, technology, governments, and energy-intensive industries to deliver the energy transition to net zero carbon.

We support tested technologies ready for wider commercialization. We are interested in any technology supporting the energy transition and the decarbonization of demand.

Customer Focused

Value driven

Jon Matthews

(Group Head of Capital Investment, Planning & Innovation) - AGS Airports

" IKIGAI has been the catalyst for AGS Airports to understand how the daunting task of decarbonizing our operations, and that of our industry, can be achieved in a pragmatic and cost-effective mechanism. Bankability means risk identification, mitigation, and allocation to the best party that can manage that risk, creating the conditions for institutional investors to fund the technology. "

Jordi Francesch

(Managing Director Asset management) - Glennmont Partners/Nouveen

"Ikigai has a straightforward approach to helping infrastructure and energy investors optimize and future-proof their asset."

Our vision? Become a leader to support the decarbonization of hard-to-abate sectors.

Ikigai aims to become a leading international, technology-neutral ‘energy transition platform’ focused on attracting investment into:

- Energy and decarbonization solutions for industry and infrastructure owners

- Proven but not yet commercially scaled efficient, renewable, and low carbon power, heat, and fuel-related technologies

Our founders

Helena Anderson

Co-founder and COO

Roberto Castiglioni

Co-founder and CEO